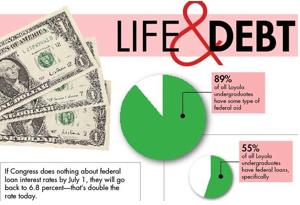

The interest rates on subsidized Stafford loans are expected to double in July, an increase that could heap thousands of dollars on top of an undergraduate student’s debt.

President Barack Obama addressed the issue in his Jan. 24 State of the Union speech by urging Congress to prevent the increase from happening.

Obama’s proposal would extend the current rate for one year.

Cathy Simoneaux, director of the Office of Scholarships and Financial Aid, said the interest rate on subsidized Stafford loans for undergraduate students is 3.4 percent.

“Congress, a couple of years ago, cut the interest rate on student loans for undergraduate students, and so if Congress does nothing, the interest rate goes back to the statutory maximum of 6.8 percent in July,” Simoneaux said.

Sociology sophomore Mary Cassibry said she is paying for college on her own with the help of financial aid and federal loans. She said her biggest fear is that the impact of higher interest rates could keep her from attending graduate school.

Assuming an average student loan debt is $25,250 with a payback period of 15 years, monthly payments will then be increased by $44.87 per month at 6.8 percent interest. Students paying off loans at 6.8 percent interest will spend a total of $8,076.32 more over the 15-year payback period.

Simoneaux said it is important for undergraduate students to make their opinions on the matter known to Congress by contacting their elected representatives.

“We’d like it to change,” said Simoneaux. “We’d like y’all to make some noise.”

According to Director of Government Relations, Tommy Screen, students are encouraged to speak out in an effort to protect student loan interest rates.

Screen said that students from Louisiana who need help drafting a letter or coming up with talking points are welcome to contact him at [email protected].

Scott O’Brien can be reached at [email protected]