Recent alumni take advantage of stimulus check

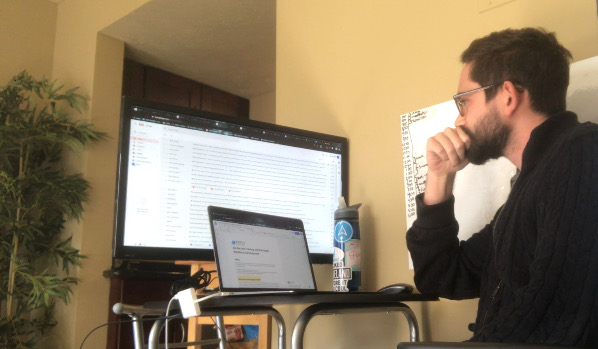

Alumnus Bryant Istre working on data analysis for the Tech Elevator Coding Bootcamp. Istre has been working remotely in Cleveland since March. Photo courtesy of Bryant Istre.

April 22, 2020

Bryant Istre A’19, is feeling fairly fortunate in the midst of a national pandemic.

Istre is one year out of college, and he has a job that can be done fully remotely in an industry that he says is well-insulated from the crisis: education.

But he understands that his financial security may not last forever, so Istre plans on setting the $1,200 for a rainy day.

“Things are great right now, but who knows how long this thing is going to last?” said Istre. “If it lasts six months, my company might still do great. But if it lasts a year, and everyone’s out of money, then no one can afford to retrain and we might have to look at this very differently.”

Istre was able to qualify for an economic impact payment of $1,200 because he filed as an independent on his 2019 tax returns.

All U.S. citizens are eligible for an economic impact payment as long as they cannot be claimed as dependent or on someone else’s return, have a valid social security number and make less than $75,000 as an individual (or less than $136,500 as a head of a household or less than $198,000 as a married joint household). Heads of a household and families receive an extra $500 for each child they claim as dependent.

Recent alumni like Istre also benefit from having their federal student loans automatically being placed in an administrative forbearance. This allows federal student loan borrowers to stop making payments from March 13 to Sept. 30, 2020.

In the same time period, interest on federal student loans are at 0%. The Federal Student Aid website recommends contacting your loan servicer to determine if your loans are eligible, and if you are not sure who to contact, visit StudentAid.gov/login or call the Federal Student Aid office. Private student loans are not eligible for the 0% interest benefit.

However, most federal loans have a six month grace period for recent graduates before they must begin making payments anyway.

Dan Reidy, A’19, was less fortunate than Istre. Reidy was working as an advisor for the Pi Kappa Phi fraternity for chapters in colleges in the northeast region. However, his first year on the job was cut short due to COVID-19.

“The end of my term was supposed to be around early May, then I got laid off, which was whack,” said Reidy. “They pretty much let us know that our time would be ending sooner than we thought because a lot of money wasn’t coming in.”

Reidy was also filed as a dependent on his parents’ tax returns. So while families do receive an extra $500 for each child claimed as dependent, Reidy will not be receiving an extra $500 because only dependents under the age of 17 qualify for the extra $500.

Reidy is back home now with his parents in South Carolina, but his plan is to eventually move forward in his career and move back to the northeast.

“Obviously the pandemic puts a wrench into things, but that doesn’t mean there’s nothing to do, even though it can feel hopeless,” said Reidy. “Going on LinkedIn, going on Indeed, stuff like that, just putting feelers out to see if there aren’t many employment opportunities at the moment.”

Reidy filed for unemployment this month, and plans to put those funds into savings as he continues his job search in the midst of the pandemic.