Students aid community with tax prep

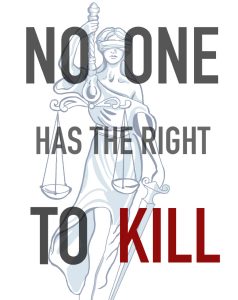

Sergey Garanyants (center), third year law student, helps a married couple during a session at the College of Law’s Volunteer Income Tax Assistance program. The VITA program offers free tax preparation for moderate to low-income tax payers and Loyola students.

March 5, 2015

Clicking keys and smiling faces welcomed clients to their tax sessions, but the Loyola law school computer lab is not a traditional tax center.

Andrew Piacun, Loyola College of Law assistant dean of administration, leads a team of students to prepare over 700 tax returns annually. The Volunteer Income Tax Assistance program team has offered free tax help to people facing tough times for over 30 years.

During Piacun’s 10 years with the program, the group has filed about 6,000 tax returns for local people earning low to moderate incomes. He said he keeps coming back for the people.

“Some of the people that come back year, after year, after year are the friendliest people in the world. They’d be your friend for life from the moment you met them, and they are just very good, down to earth people. That’s probably the most rewarding thing,” Piacun said. “It’s exhilarating. It’s exhausting. It’s fun. It’s frustrating.”

Jamie Johnson, third year law student and program volunteer, said the program allows her to bond with locals.

“In law school you are sort of blocked up in the classes, and being able to do this in the community makes me feel like I am more connected to the people I am surrounded by in the community instead of just sticking to my law classes,” Johnson said. “Not only are we sitting here plugging in numbers but we are actually getting to know our community members.”

Piacun said students can be hesitant about joining the program because they are unfamiliar with preparing taxes, so volunteers are trained.

“They are interested in it, but they are scared. They don’t know what taxes are. They aren’t good with the numbers,” Piacun said. “The majority of what you do is helping people. That’s what it comes down to.”

He said students can benefit much more than their mandatory service hours.

“We have such a variety of people that you don’t know who is going to sit in front of you,” Piacun said.

Johnson said she has enjoyed her time with the program.

“It’s great to meet the different types of people. It’s a wide variety of people that come here,” Johnson said.

She said her first day on the job showed her that most people are thankful.

“They are super grateful,” Johnson said. “They are extra appreciative of everything we do here.”

Guillaume Tabet, native of France and French teacher at Audubon Charter School, said he is one of many people grateful for the tax help.

Tabet said Piacun helped break down tax terms for him.

He also said the volunteers’ friendly attitudes stood out.

Piacun said the program’s future depends on volunteers. However, due to the nature of the program volunteers change often.

“The hard part is once the students get very comfortable with what they are doing, they graduate,” Piacun said. “If I could keep them, we would have one heck of a crew of tax preparers and tax specialists. That’s one of the challenges that never goes away.”

Piacun said tax season does not have to be filled with stress.

“You develop a relationship and a rapport with your client, make them comfortable and make them happy with what we are doing, and at the end of the day everyone’s having a good time. Trust me, you can have fun doing taxes,” Piacun said.