Compared to other private institutions, the number of students who default on their student loans at Loyola University is low.

In 2008, the national average of students at a private institution who defaulted on their loans was 4.6 percent, at Loyola the number was 1.8 percent. According to Loyola’s website, this is an accomplishment for a school where 63 percent of students take out loans to pay for their education.

According to Loyola’s website, “Default is a legal term which describes a borrower’s failure to repay a loan according to the terms agreed to when he/she signed a promissory note.”

One of the reasons for Loyola’s low number of defaulted loans is the way in which the school has prepared its graduates for financial success and responsibility.

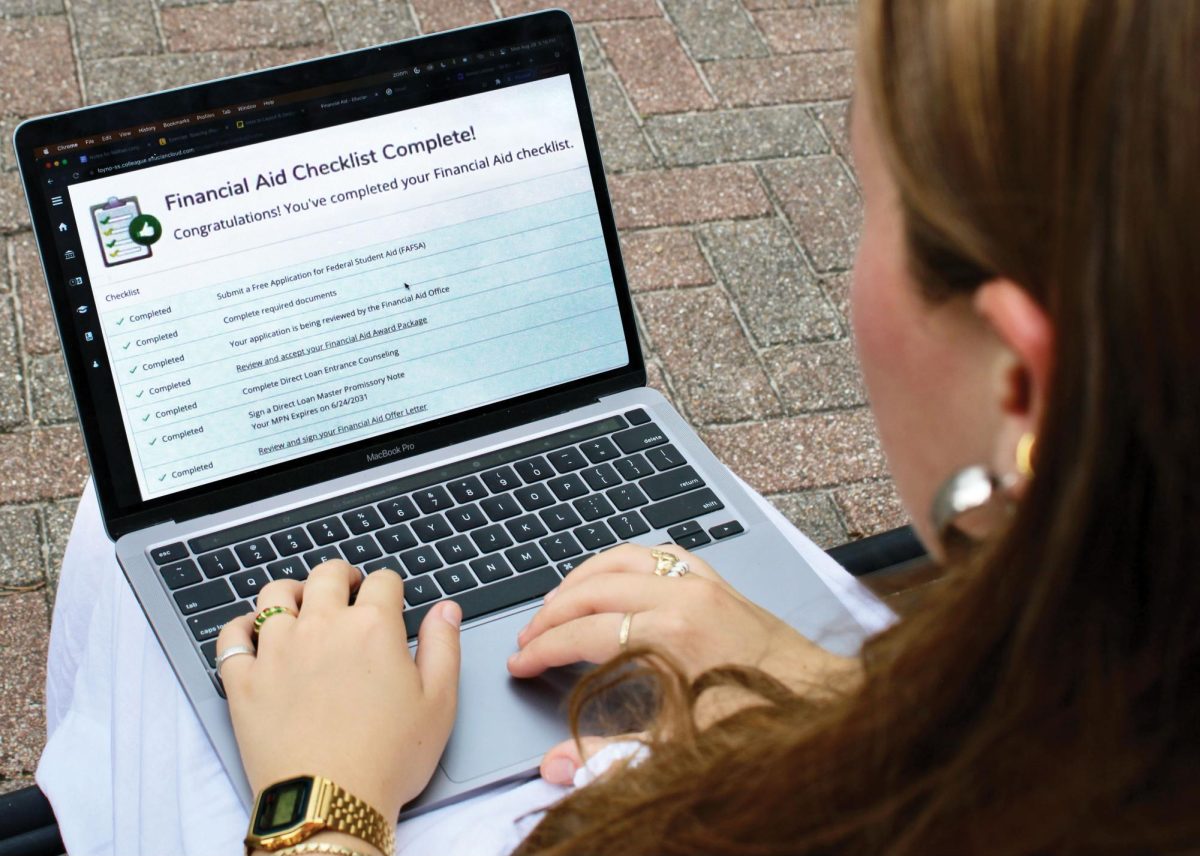

According to Cathy Simoneaux, Interim Director of the Office of Scholarships and Financial Aid, there are many resources to help students “borrow smartly.”

The Scholarship and Financial Aid website offers a variety of information on default prevention and management, planning and repayment, and financial literacy education.

“We have a couple of newsletters, including ‘One Step Ahead’ for students with loans and students can ‘like’ our Facebook page and follow us on Twitter and YouTube, as we are always sending out new information to help people learn how to make wise financial decisions,” said Simoneaux.

Another reason for the low number of defaulted loans is the number of students who receive financial aid at Loyola. According to Loyola’s website, 84 percent of students receive some sort of financial aid, which relieves some of the burden of paying private school tuition.

“Having the combination of a scholarship and student loans is a big part of why I’m here because I’m paying for my loans myself,” said Catherine Carter public relations junior.

In addition to the resources available for undergraduates, the Financial Aid Office has added pages on their website for upcoming and postgraduates. Students can access information on “Graduation and Beyond,” “Tips for Graduating Seniors” and a separate section for alumni.

Simoneaux advises students to take advantage of the resources available to them.

“We would like to see more students use the online counseling programs throughout their time in school so that they are prepared to start repaying their loans at graduation,” said Simoneaux.

Mary Jameson can be reached at