The tax cuts enacted in 2001 and 2003, known as the “Bush tax cuts”, were implemented to stimulate the economy in wake of 911. These are scheduled to expire 1/1/11. To date, Congress hasn’t addressed the issue, and it won’t until after the 11/2/10 elections. The liberals have criticized the cuts by alleging that these tax cuts favored the rich.

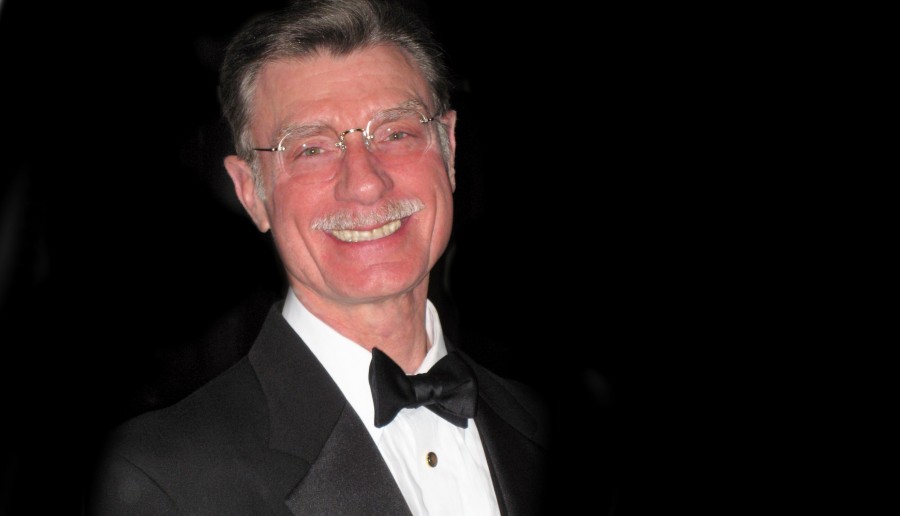

Jesuit education is a call to human excellence, to the fullest possible development of all human qualities. This implies a rigor and academic excellence that challenges the student to develop all of his or her talents to the fullest. It is a call to critical thinking and disciplined studies, a call to develop the whole person, head and heart, intellect and feelings.

Therefore, let’s apply critical thinking to evaluate this liberal mantra!

First, let’s compare the progressive, personal income tax rates for tax years 2000 and 2009. The Department of the Treasury’s Publication 17, “Your Federal Income Taxes for Individuals” is the source of these rate schedules. While there are four filing statuses (1.Single, 2.Married filing jointly or Qualifying Widow(er), 3.Married filing separately, and 4.Head of Household), the rates are the same. However, the floor and ceiling of each income bracket differ for each filing status. I shall focus the analysis on the Single Taxpayer filing status, since most of our students are single taxpayers:

|

2000 |

2000 Single Taxpayer’s Income Bracket |

2009 |

2009 Single Taxpayer’s Income Bracket |

Rate Reduction from 2000 to 2009 |

|

15% |

< $26,250 |

10% |

<$8,350 |

5% |

|

28% |

>$26250 < $63,550 |

15% |

>$8,350 < $33,950 |

13% |

|

31% |

>$63,550 < $132,600 |

25% |

>$33,950 < $82,250 |

6% |

|

36% |

>$132,600 < $288,350 |

28% |

>$82,250 < $171,550 |

8% |

|

39.6% |

>$288,350 |

33% |

>$171,550 < $372,950 |

6.6% |

|

|

|

35% |

> $372,950 |

4.6% |

|

|

|

|

|

|

The rates for 2009 were the same as those first introduced in 2003. However, the floor and ceiling for the various income brackets were increased, because the Treasury Department revises the floor and ceiling of the income brackets annually to reflect inflation. For example, in 2003, the 10% tax rate was applicable to taxable income less than $7,000; the subject taxable income was increased to $8,350 in 2009. The reader will detect that the rates enacted in 2003, and continued through 2010, added one income bracket. The reader will also discern, the rate for lowest income bracket was reduced by 5%, and the rate for the highest income bracket was reduced by 4.6%. To be current, I shall direct my explanation of income brackets to the 2009 income brackets for a single taxpayer.

In 2009, the 10% rate was applicable to a single taxpayer whose taxable income was less than $8,350. This was a reduction of 5 % for the lowest tax income bracket when compared to the 2000 tax rates. The15% tax bracket, which was reduced by 13%, was applicable to that portion of a single taxpayer’s taxable income between $8,351 and $33,950. The 25% bracket, which was reduced by 6%, was applicable to that portion of a single taxpayer’s taxable income in excess of $33,950 but not over $82,250. The 28% bracket, which was reduced by 8%, was applicable to that portion of a single taxpayer’s taxable income in excess of $82,250 but not over $171,550. The 33% bracket, which didn’t exist in 2000 and is 6.6% less than the highest rate for the 2000 tax year, applies to the portion of the single taxpayer’s taxable income in excess of $171,550 but not over $372,950. The 35% bracket, which reflects a 4.6% reduction, is applicable to that portion of a single taxpayer’s taxable income in excess of $372,950.

Now, let’s apply the rates to a hypothetical taxpayer with $33,950 taxable income on the low end and $400,000 taxable income on the high end of the spectrum. As the below analysis reveals, the 2009 rates, the “Bush Tax Cuts”, reduce both taxpayer’s effective tax rate (taxes paid divided by taxable income) by 4% and 5%, respectively. This isn’t a significant difference considering the second taxpayer’s tax burden and the various stealth taxes (phase out of itemized deductions and tax credits) the wealthier taxpayers encounter when calculating taxable income.

In 2000 a single taxpayer with taxable income of $33,950 would have paid $6,094 of taxes. Consequently, the taxpayer’s effective tax rate would have been 18%. By comparison, in 2009, a single taxpayer with taxable income of $33,950 would have paid $4,675 of taxes, resulting in a 14% effect tax rate.

In 2000 a single taxpayer with taxable income of $400,000 would have paid $136,070 of taxes, resulting in a 34% effective tax rate. In 2009, the same taxpayer would have paid $117,683, a 29% effective tax rate.

Now, let’s examine the capital gain structure, which has also been characterized as favoring the rich. Again, the Department of the Treasury’s Publication 17, “Your Federal Income Taxes for Individuals” is the source of these rate schedules:

|

If net capital gain is from: |

2000 |

If net capital gain is from: |

2009 |

|

Collectibles |

28% (1) |

Collectibles |

28% |

|

Qualified small business stock equal to 1202 exclusion |

28%(1) |

Qualified small business stock= to 1202 exclusion |

28% |

|

Unrecaptured 1250 gain |

25%(1) |

Unrecaptured 1250 gain |

25% |

|

Other gain & regular tax >28% (3) |

20% |

Other gain & regular tax >25%(3) |

15% |

|

Other gain & regular tax is 15%(3) |

10% (2) |

Other gain & regular tax is < 25% (3) |

0% |

Footnotes to capital gain table:

- 15% if regular tax is 15%

- 10% rate applies to the part of capital gain that would be taxed at 15% if there were no capital gain rates.

- Other gain means any gain that is not collectibles gain( art, antiques, gems, metals, stamps coins, bullion and alcoholic beverages), gain on qualified small business stock( stock acquired directly from “C” Corporation after 8/10/93; the corporation has assets of $50 million or less and shareholder held the stock for 5 years) , or unrecaptured section 1250 gain.

As can be seen from the above table, the capital gains rates were basically the same, pre- “Bush tax cuts” and post-“Bush tax cuts”, for “Other Gains”. Thus, I direct the reader’s attention to those rates. In 2000 if the taxpayer’s marginal tax rate was 28% or higher, the taxpayer paid 20% of the capital gain as tax. If the taxpayer’s marginal rate was 15%, the lowest tax rate in 2000, the taxpayer paid 10% of the capital gains as tax. In 2009, however, if the taxpayer’s marginal tax rate was either 10% or 15%, the capital gains would not be taxable. If the taxpayer’s marginal rate was 25% or higher, the capital gains were subject to 15% tax. As can be seen, both low income taxpayers and high income taxpayers benefited from the capital gains tax rate reductions. Those in the 10% or 15% marginal tax brackets realized a 10% reduction; however, those in the 25% or higher marginal tax bracket only realized a 5% capital gain tax rate reduction.

If the foregoing hasn’t disproved the liberals’ sound bites, let’s consider the following statistics published by the Heritage Foundation (www.heritage.org/research/taxes/wm2420.cfm):

In 2006, 97% of the individual Federal income taxes were received from 50% of the taxpayers. The top 10% of the taxpayers paid 71% of all Federal income Taxes, while the bottom 50% of the taxpayers paid less than 3%. The top 1% of the taxpayers paid 40% of all Federal Income taxes. Additionally, of the 136 million returns processed, at least 43 million owed no tax, and many of those received an earned income credit (if taxpayer’s earned income is below the IRS specified amounts, the taxpayer receives a tax credit. For instance, in 2009, if a single taxpayer with 3 or more children had earned income of less than $16,420, the taxpayer receive6 a $5,657 tax credit.) Add to this figure the 15 million households and individuals who file no Federal income tax return, and it appears that 40% of the US population paid NO Federal income tax.

The general rule is that a tax return is required for every individual who has gross income, income from whatever source derived unless the tax code specifically excludes the income, which equals or exceeds the sum of the exemption amount plus the applicable standard deduction. In 2006, the standard deduction, which is based on filing status, was:

|

Filing Status |

2006 Standard Deduction |

|

Single & Married filing separately |

$5,150 |

|

Married filing joint return or Qualified window(er) with dependent child |

$10,300 |

|

Head of Household |

$7,550 |

The personal exemption was $3,300 in 2006. Thus, if a single taxpayer had gross income of less than $8,450, the taxpayer wasn’t required to file an income tax return.

The above statistics have been consistent for the past several years.

From the above analysis, one must conclude that all taxpayers benefited from the Bush tax cuts, and approximately 40% of the population gets a free ride. So, which group is the favored group?

Now, consider the statement which the loquacious Joe Biden made on ABC’s “Good Morning America” and reported in the Los Angeles Times’ 9/18/08 article, “Joe Biden calls it ‘Patriotic’ for wealthy to pay more taxes.” When the ABC’s “Good Morning America” interviewer noted that Obama was targeting the affluent, Biden stated, “You got it! It’s time (for the well-off) to be patriotic.”

This is the most inane statement I have heard from the Washington elite in a long time! Biden is an attorney by education; yet, he appears to be ignorant of Judge Learned Hand’s (graduated with honors from Harvard Law School, Judge of the US Court of Appeals for the Second Circuit, and judicial philosopher) opinion in Commissioner v. Newman 47-1 USTC Par 9175, 35AFTR 857, 159 F.2d 848(CA-2, 1947):

“Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands; taxes are enforced extractions, not voluntary contributions. To demand more in the name of morals is mere cant”

This is a prime example of what happens when we elect a liberal theorist, one who has never had a real job in which their and their employees’ livelihood depend on providing value to their customers and clients. These career politicians are completely out of touch with “real life” in the U.S.

President Reagan was most eloquent in his assessment of the liberals, “The trouble with our liberal friends is not that they’re ignorant; it’s just that they know so much that isn’t so.” And, P.T Barnum warned, “There’s a sucker born every minute.” Critically think before accepting anyone’s hypothesis, recommendation, opinion, etc., particularly this liberal diatribe.